PM Modi’s GST Cuts: New Tax Slabs & What Gets Cheaper

India overhauls GST with simplified two-slab structure, providing relief to households and businesses ahead of the festive season.

PM Modi’s GST Cuts: New Tax Slabs & What Gets Cheaper. In a significant move aimed at boosting consumption and easing the burden on the common citizen, the Indian government has announced a sweeping overhaul of the Goods and Services Tax framework. The landmark decision, which has been widely hailed as a “GST Diwali bonanza,” simplifies the existing four-tiered tax structure into a new, more rationalized system.

This reform, effective from September 22, the start of the Navratri festival, is set to make a wide range of essential and household items significantly cheaper.

Tweets on ‘X’ !— Nirmala Sitharaman Office (@nsitharamanoffc) September 3, 2025

Hon’ble Prime Minister Shri @narendramodi announced the Next-Generation GST Reforms in his Independence Day address from the ramparts of Red Fort.

Working on the same principle, the GST Council has approved significant reforms today.

These reforms have a multi-sectoral and… pic.twitter.com/NzvvVScKCF

— Nirmala Sitharaman Office (@nsitharamanoffc) September 3, 2025

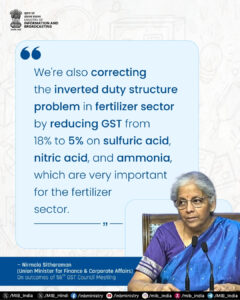

The core of the reform is the transition from the old four-slab system (5 percent, 12 percent, 18 percent, and 28 percent) to a simplified two-rate structure of 5 percent and 18 percent. This rationalization is expected to have a far-reaching impact, particularly on middle-class households.

Tweets on ‘X’ !— Trade Brains (@TradeBrainsGrp) September 4, 2025

NEXT-GEN GST REFORM 2025 👇 pic.twitter.com/LU6lzHa7kI

— Trade Brains (@TradeBrainsGrp) September 4, 2025

A special 40 percent rate has been created for select “sin” and ultra-luxury goods like tobacco products and high-end vehicles, ensuring that the benefits of the tax cuts are directed towards mass consumption goods.

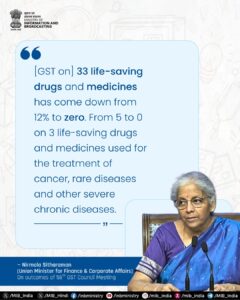

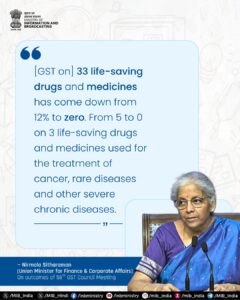

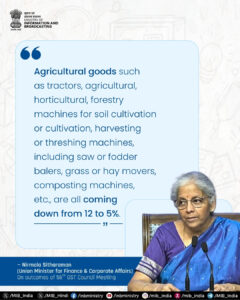

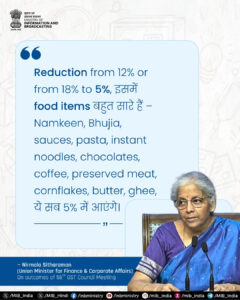

The list of items seeing a tax reduction is extensive, covering everything from daily necessities to consumer durables. Products previously in the 18 percent and 12 percent slabs, such as hair oil, toothpaste, soap, shampoo, and packaged foods like namkeens, biscuits, and chocolates, will now fall under the 5 percent category.

Tweets on ‘X’ !— Ashwini Vaishnaw (@AshwiniVaishnaw) September 4, 2025

Next-gen reforms in GST

🟡 5% for essentials

🟠 18% for standard goods

🔴 40% for super luxury & sin items🧵See what all gets cheaper👇 pic.twitter.com/L03qFThYBF

— Ashwini Vaishnaw (@AshwiniVaishnaw) September 4, 2025

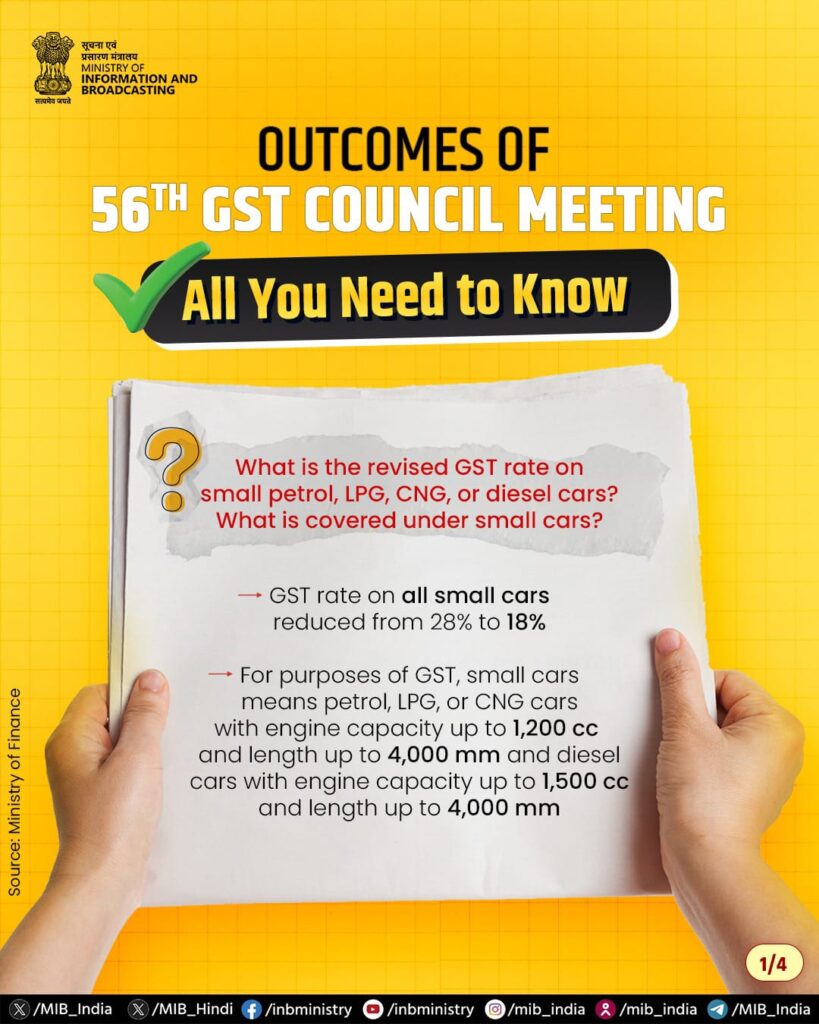

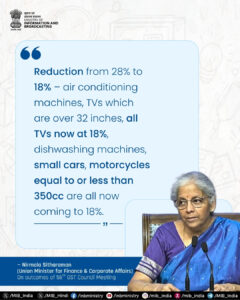

Furthermore, major durables like air conditioners, televisions, and small cars will see a significant drop from 28 percent to 18 percent.

Even life and health insurance premiums, which were earlier taxed at 18 percent, will now be exempt from GST, a major relief for millions of policyholders. The government’s vision is to stimulate demand, drive economic growth, and simplify compliance for businesses, creating a more favorable economic environment for all. The market’s positive reaction, with stocks showing a clear upward trend, underscores the confidence in this new policy direction.

Source : https://mib.gov.in

https://financialservices.gov.in

Pittsburgh Marathi Mandal Ganeshotsav:39th Annual Celebration

Pittsburgh Marathi Mandal Ganeshotsav:39th Annual Celebration

PM Modi’s Vision @SEMICON 2025 : “Chips are Digital Diamonds”

PM Modi’s Vision @SEMICON 2025 : “Chips are Digital Diamonds”

“Handshake Diplomacy : Modi, Putin, Xi and the U.S. Effect”

#Maharashtra: शिक्षणव्यवस्था खरीखुरी लोकाभिमुख अशी केली!