#UnionBudget2026 Decoded. All The Points, That Matter2You!

Top Pointers at a glance, if you, as a taxpayer, couldn't follow the Budget Speech..

#UnionBudget2026 At A Glance.. All Those Points That Really Matter To You! http://www.indiainput.com has your back covered. So that, you don’t lose the key points that matter. Come, lets get to the points that really need to be looked at. Enlisted By the Experts in Economic matters, the Chartered Accountant couple, Yash & Ruchi Verma, from Central India. Let’s read on..

Major Direct Tax Proposals in Budget 2026

1. New Income Tax Act, 2025

– Replaces the Income Tax Act, 1961 after more than six decades.

– Designed to be simpler, more transparent, and citizen-friendly.

– Redesigned tax return forms for easier filing, especially for salaried and small taxpayers.

– Staggered filing deadlines to reduce congestion and system overload.

2. Taxpayer Reliefs

– No change in tax slabs: The exemption limit remains ₹12 lakh annual income under the new regime.

– Exemption of MACT (Motor Accident Claims Tribunal) interest from tax, with no TDS deduction.

– Lower TCS (Tax Collected at Source) on overseas tour packages, education, and medical remittances.

– Clarity on TDS for manpower supply to avoid disputes.

– Automated lower or nil TDS certificates for eligible taxpayers.

– PAN-based TDS for non-resident property sales, simplifying compliance for NRIs.

– Extended timelines for filing revised and updated returns, giving taxpayers more flexibility.

3. Foreign Asset Disclosure Scheme

– A one-time settlement scheme for individuals with undisclosed foreign assets.

– Provides immunity for small taxpayers who voluntarily disclose, reducing fear of prosecution.

– Aimed at encouraging transparency and reducing black money abroad.

4. Litigation Reduction & Compliance Simplification

– Integrated assessment-penalty orders to streamline processes.

– Reduced pre-deposit requirements for appeals, making it easier for taxpayers to contest disputes.

– Decriminalisation of minor defaults (e.g., small filing delays).

– Graded punishments for different levels of non-compliance, ensuring proportionality.

– Expanded immunity frameworks to protect honest taxpayers from harsh penalties.

5. Sector-Specific Measures

– Relief measures for the IT sector to encourage innovation and attract global investment.

– Rationalisation of rules for buyback tax and corporate restructuring.

– Support for startups and MSMEs through simplified compliance norms.

6. Filing Deadlines

– Salaried taxpayers: Deadline remains July 31.

– Non-audit trusts: Extended to August 31.

– ITR-1 and ITR-2: Filing deadline continues to be July 31.

– Government considering staggered timelines for different categories to ease system load.

Major Indirect Tax Proposals in Budget 2026

1. Goods and Services Tax (GST) Reforms

– Intermediary Services Rule Changed

– Section 13(8)(b) of the IGST Act has been omitted.

– Now, the place of supply for intermediary services is based on the recipient’s location, restoring export benefits for Indian service providers.

– Valuation Simplification

– Post-sale discounts can now be excluded from taxable value even without a pre-supply agreement, provided credit notes and ITC reversal are done.

– Provisional Refunds Extended

– Up to 90% provisional refunds allowed for cases involving inverted duty structures, improving liquidity for businesses.

– Advance Ruling Mechanism

– Interim appellate mechanism introduced to address disputes, reducing uncertainty.

– GST 2.0 Roadmap

– Focus on rate rationalisation and better dispute resolution, though no major rate changes announced.

2. Customs Duty Measures

– Advance Rulings Validity Extended

– Customs advance rulings now valid for five years, providing stability for businesses.

– Tariff Rationalisation

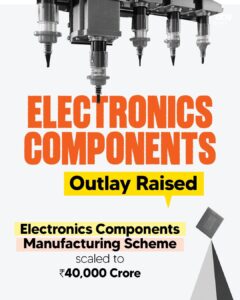

– Wide-ranging customs duty changes to streamline tariffs and support domestic manufacturing.

– Sectoral Boosts

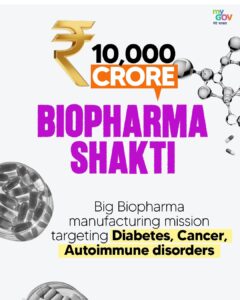

– Duty exemptions and reductions for sectors like electronics, semiconductors, biopharma, textiles, marine, and leather.

– Energy Transition Support

– Duty exemptions for nuclear power projects and renewable energy initiatives, aligning with India’s green energy goals.

3. Excise Duty Adjustments

– Chemicals and Capital Goods

– Rationalisation of excise duties to reduce costs for industries.

– Export Competitiveness

– Measures to make Indian products more competitive globally by lowering input costs.

✅ In Simple Words

– GST changes make life easier for businesses by simplifying valuation, giving faster refunds, and restoring export benefits.

– Customs duty tweaks encourage local manufacturing and exports while supporting green energy projects.

– Excise duty rationalization lowers costs for industries, indirectly benefiting consumers through cheaper goods.

Courtsey : http://mygov.in

CATCHUP FOR MORE ON : http://indiainput.com